Subtheme: Housing for the Rich

Overall Analysis Questions

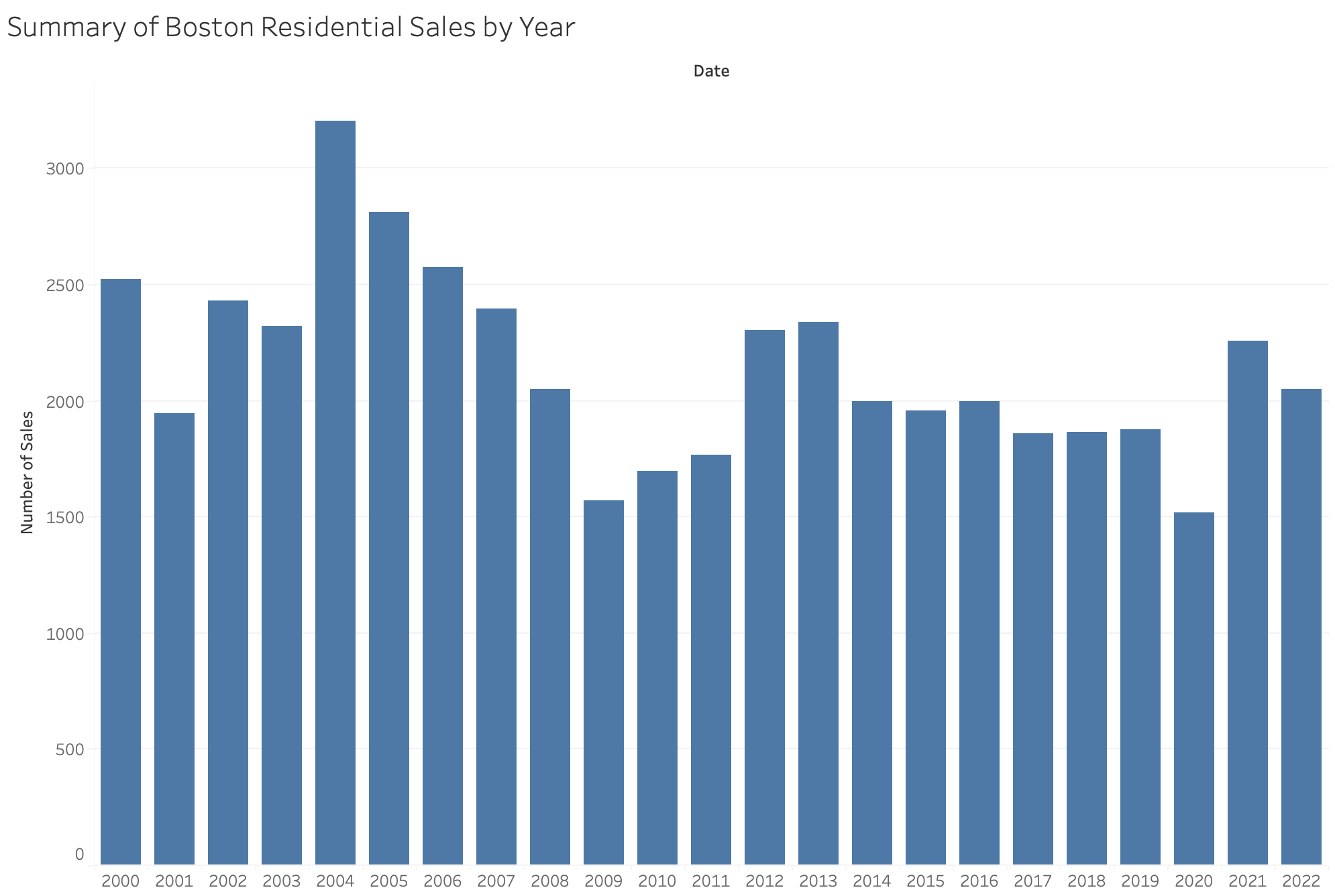

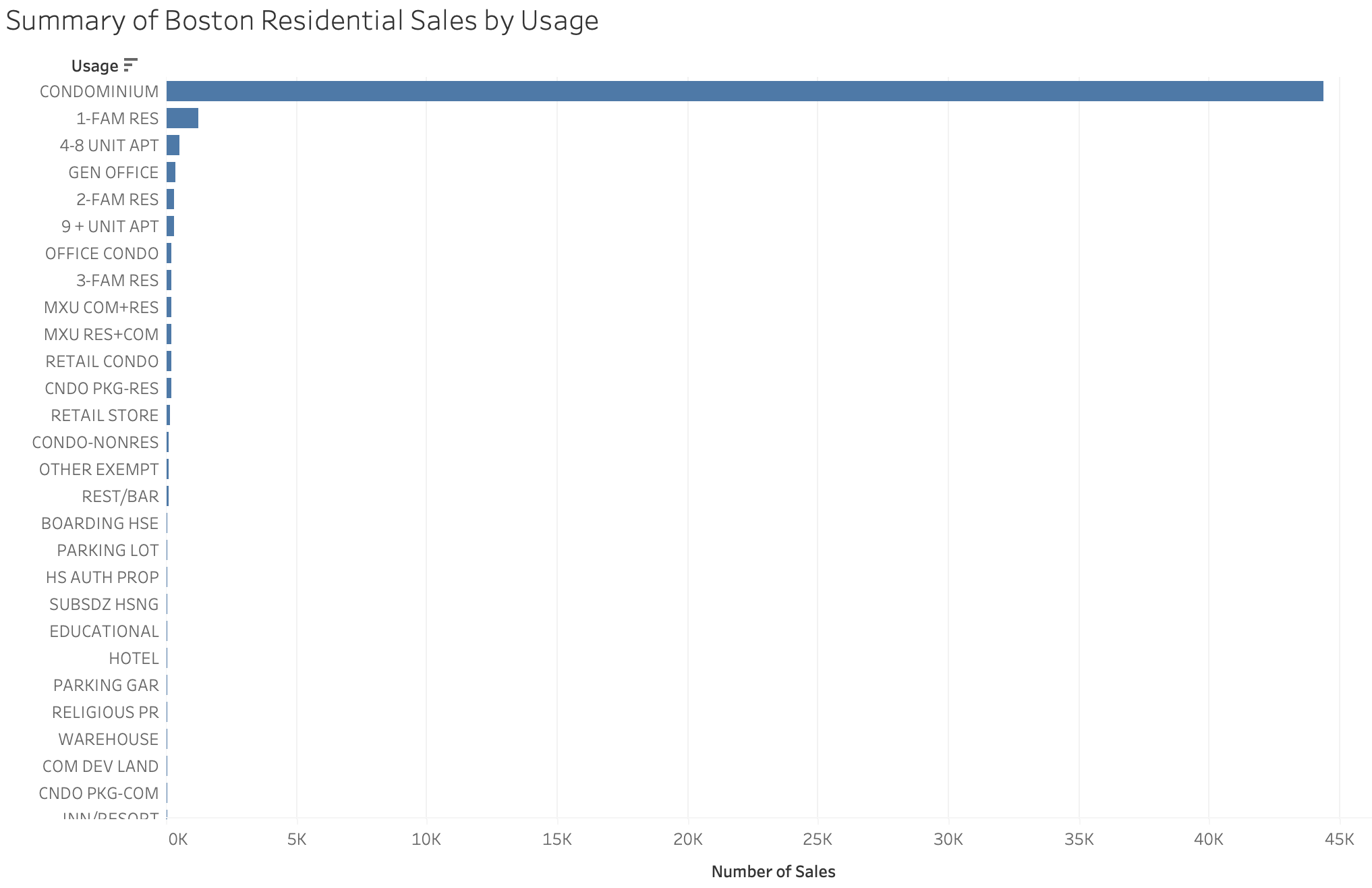

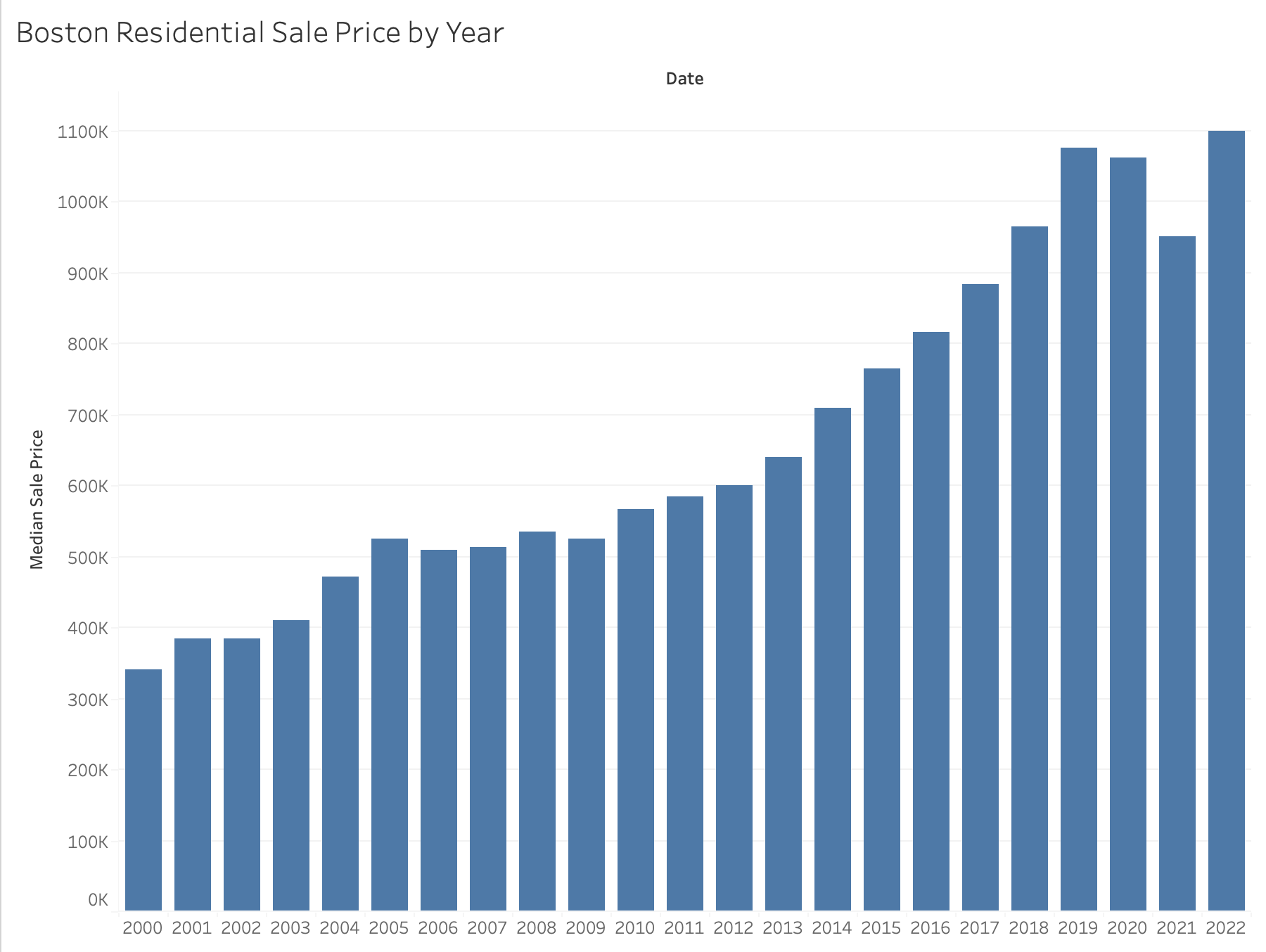

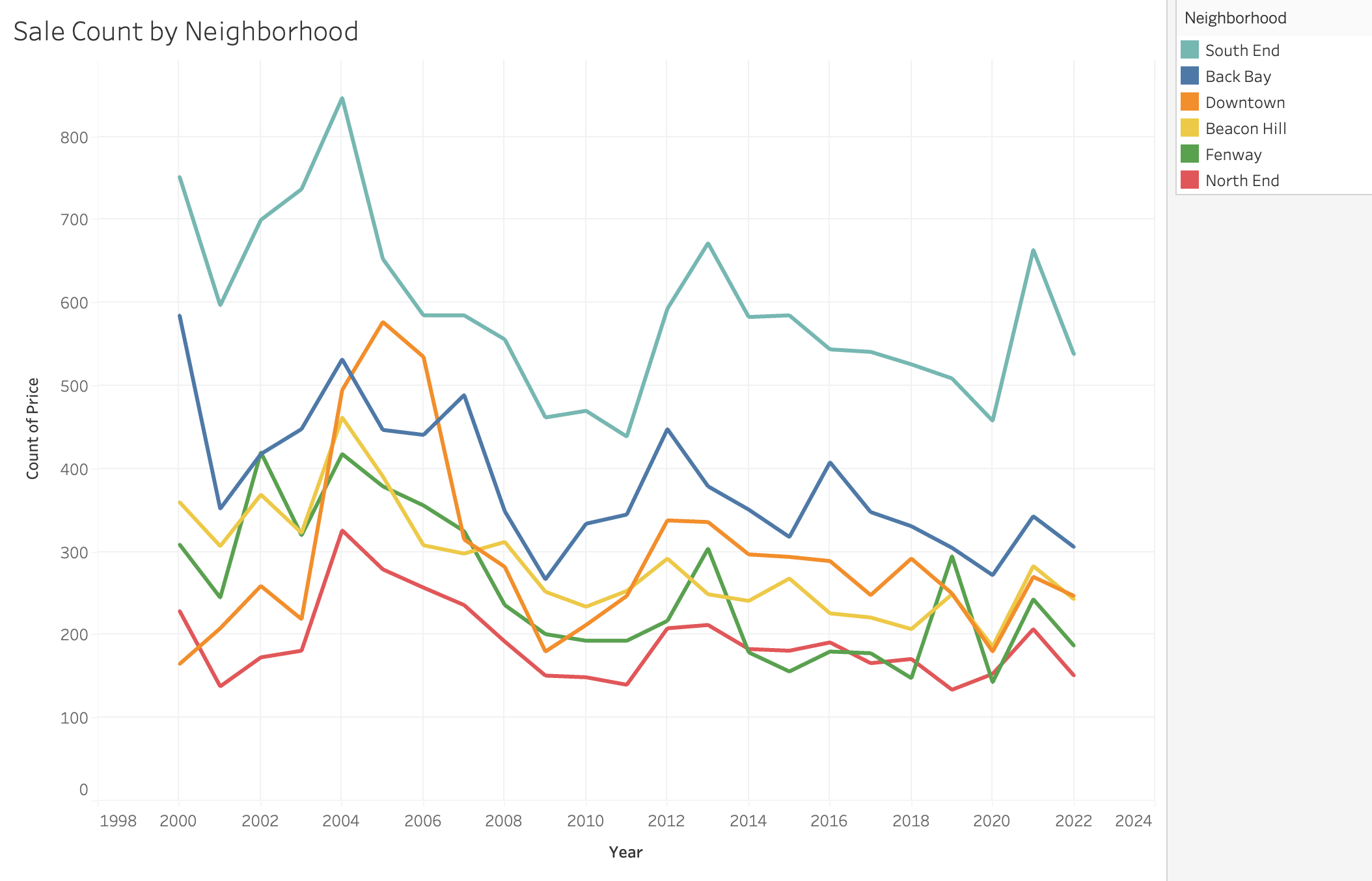

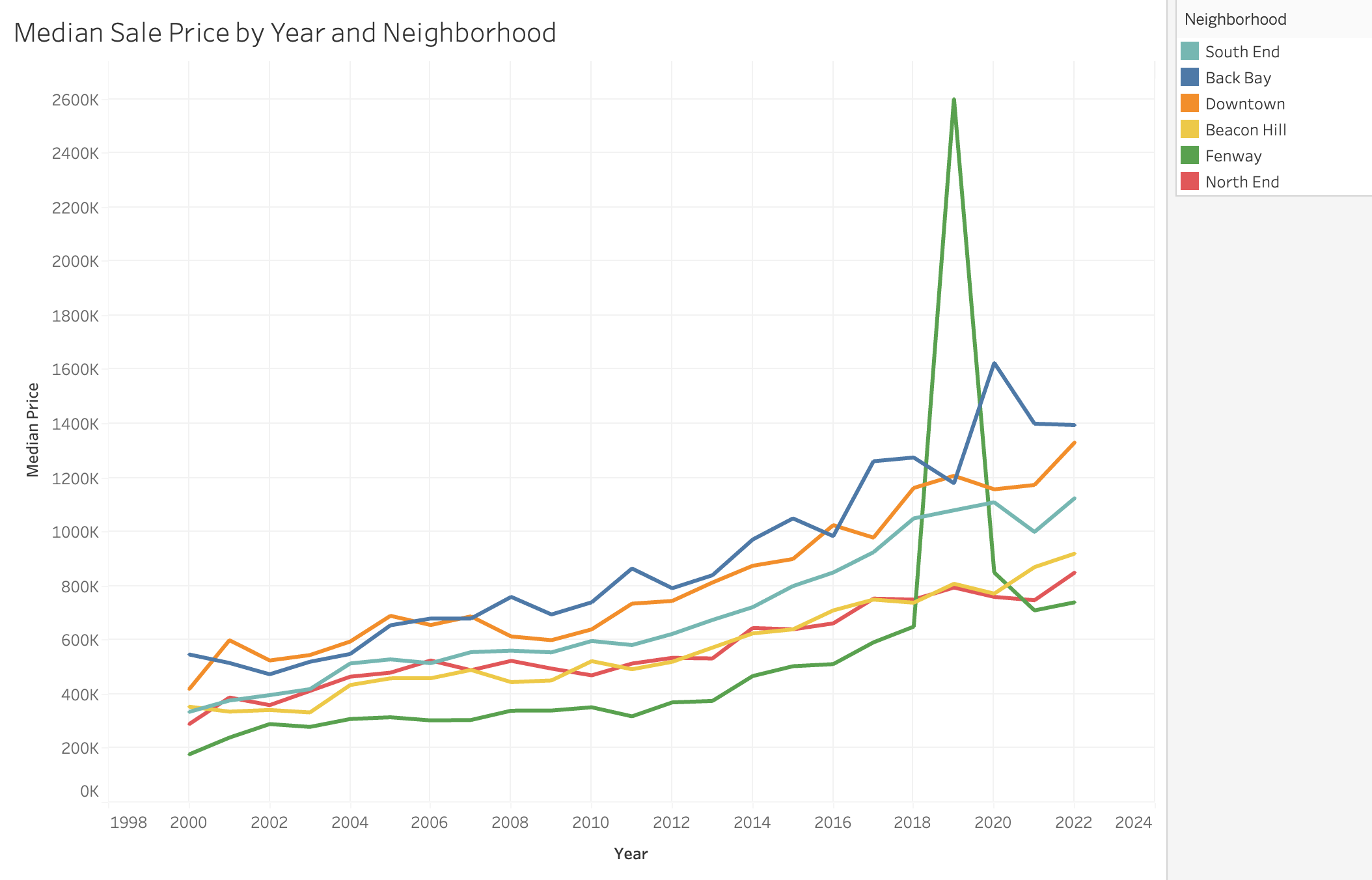

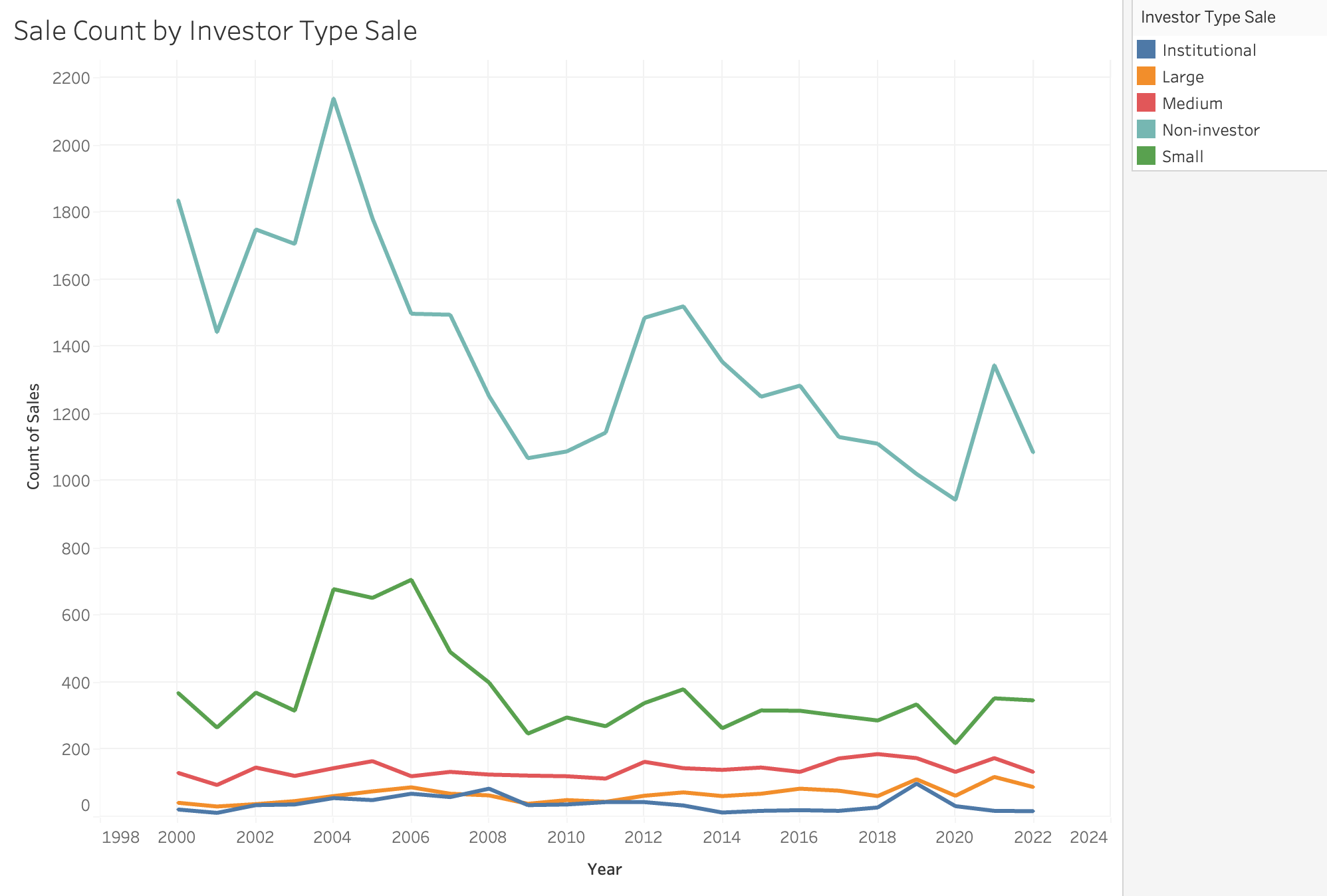

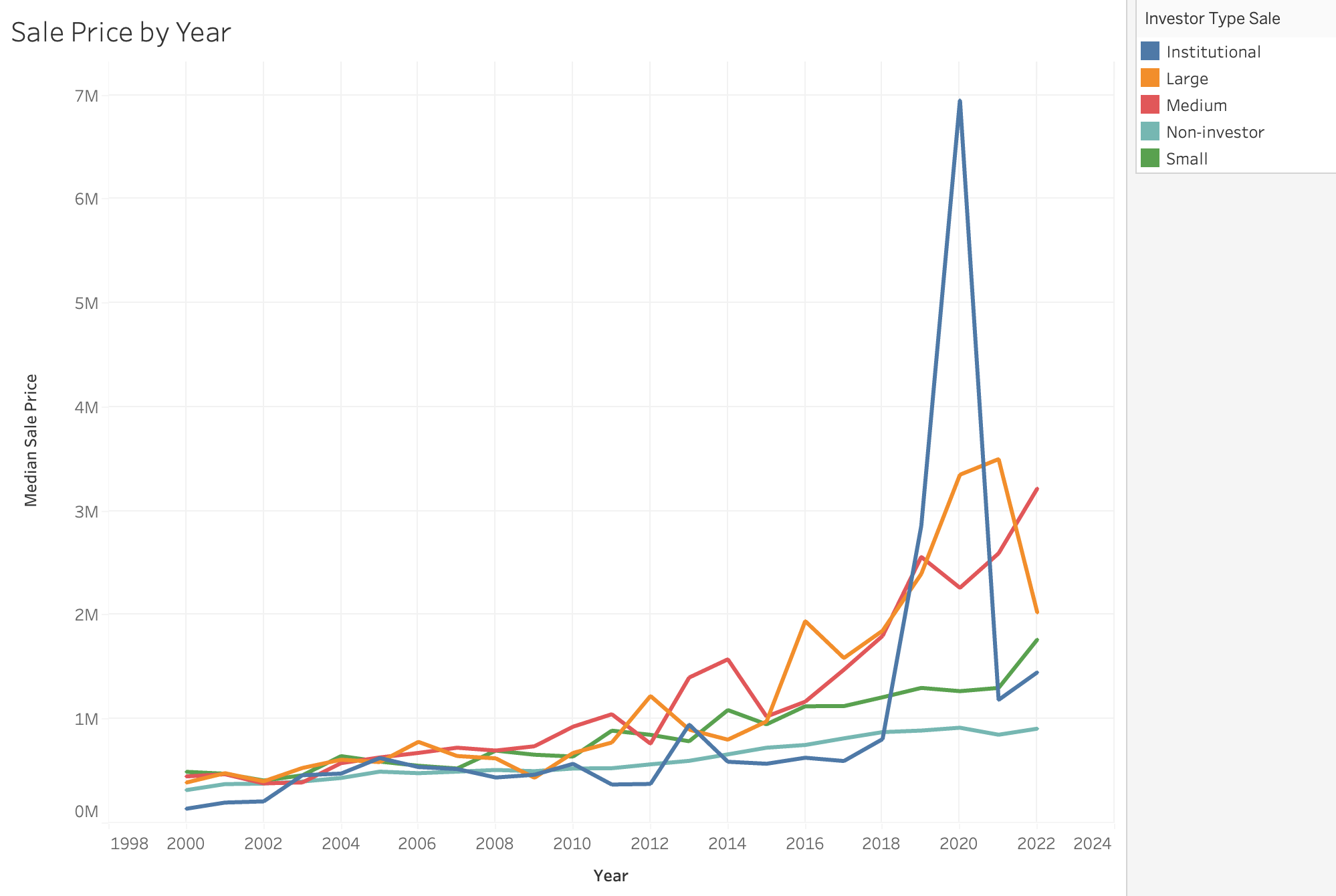

- How has the sale of residential properties changed over the time period, both in terms of sale quantity and price?

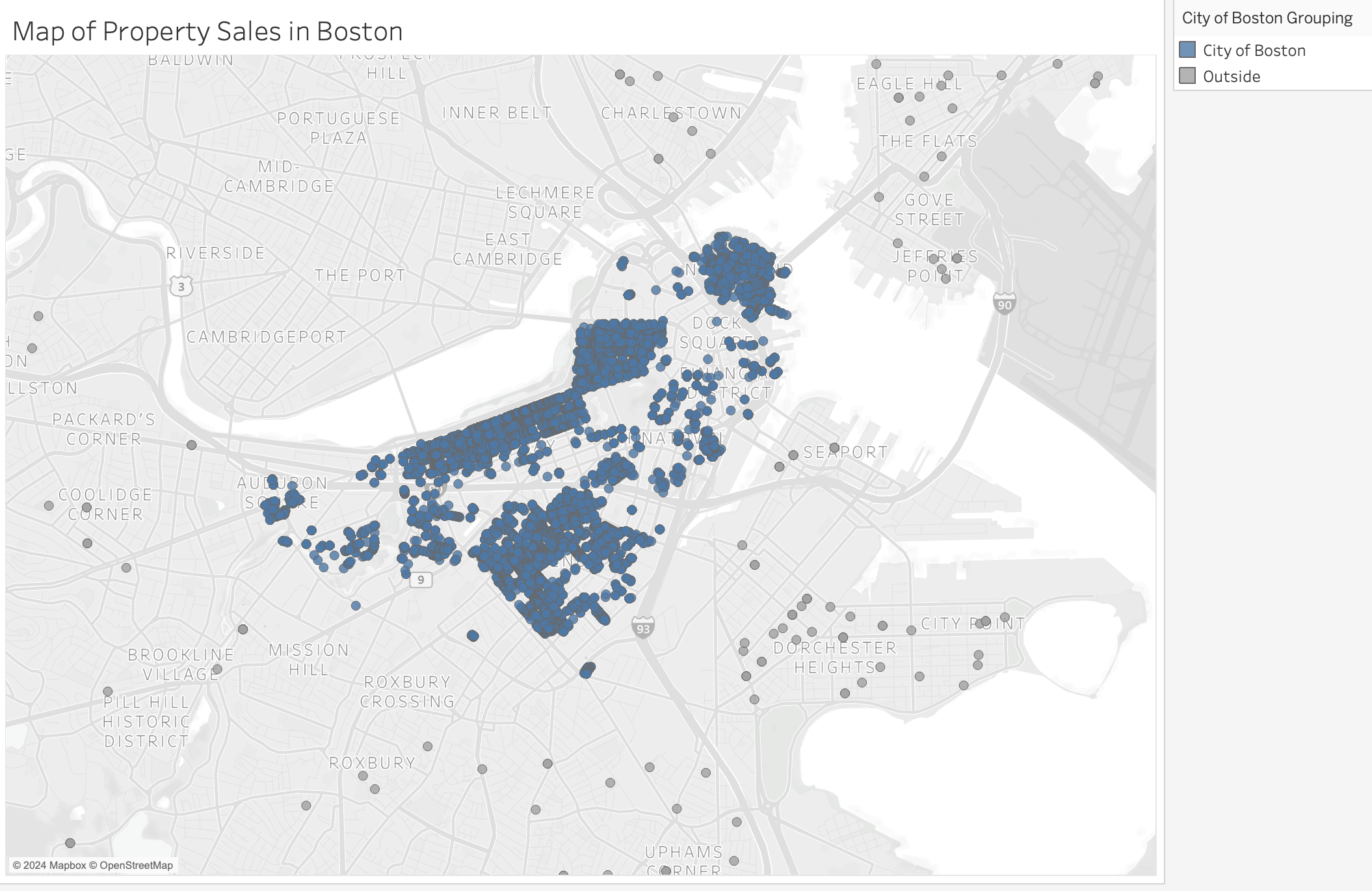

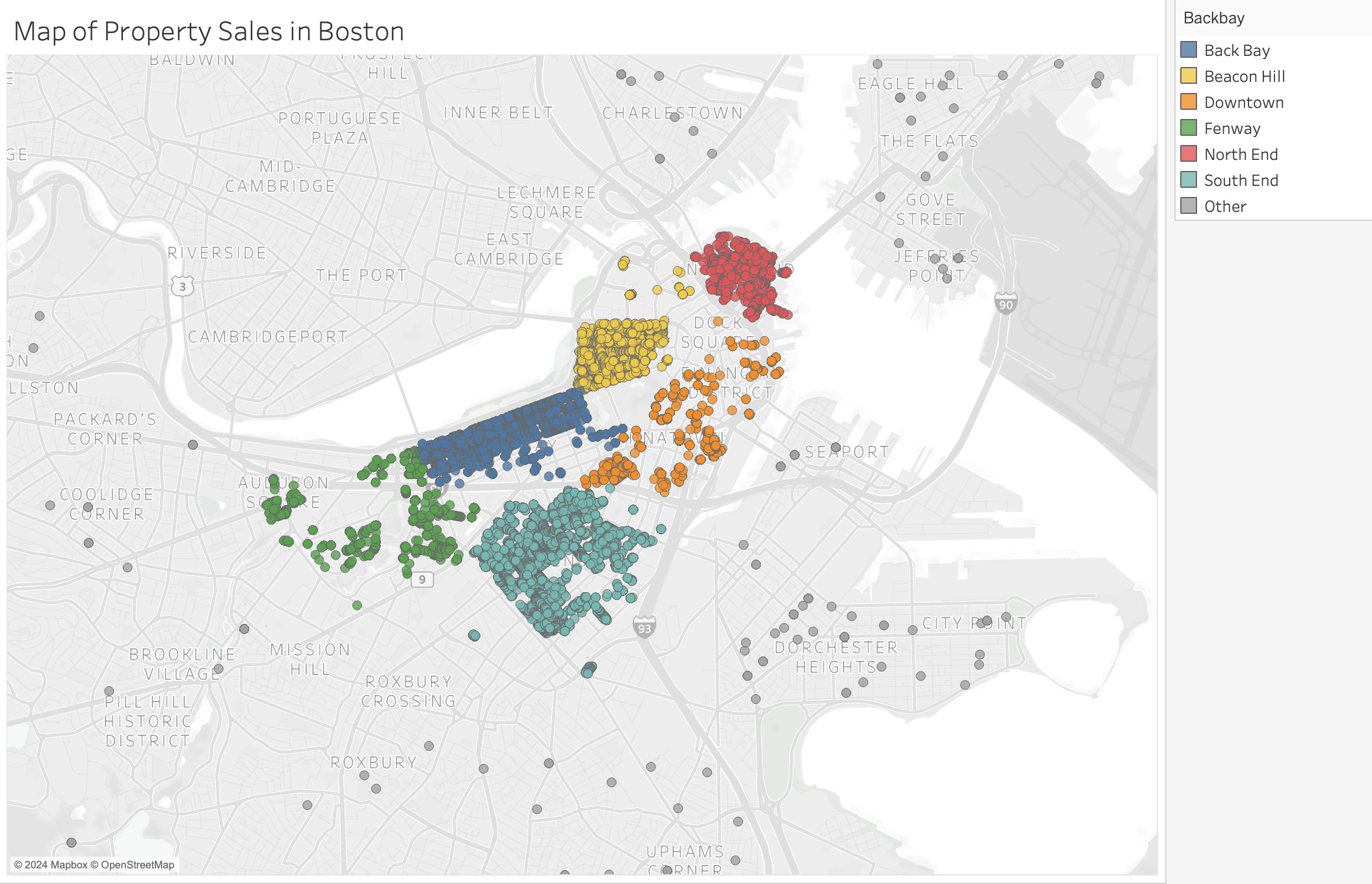

- What is the spatial distribution of sales in Boston?

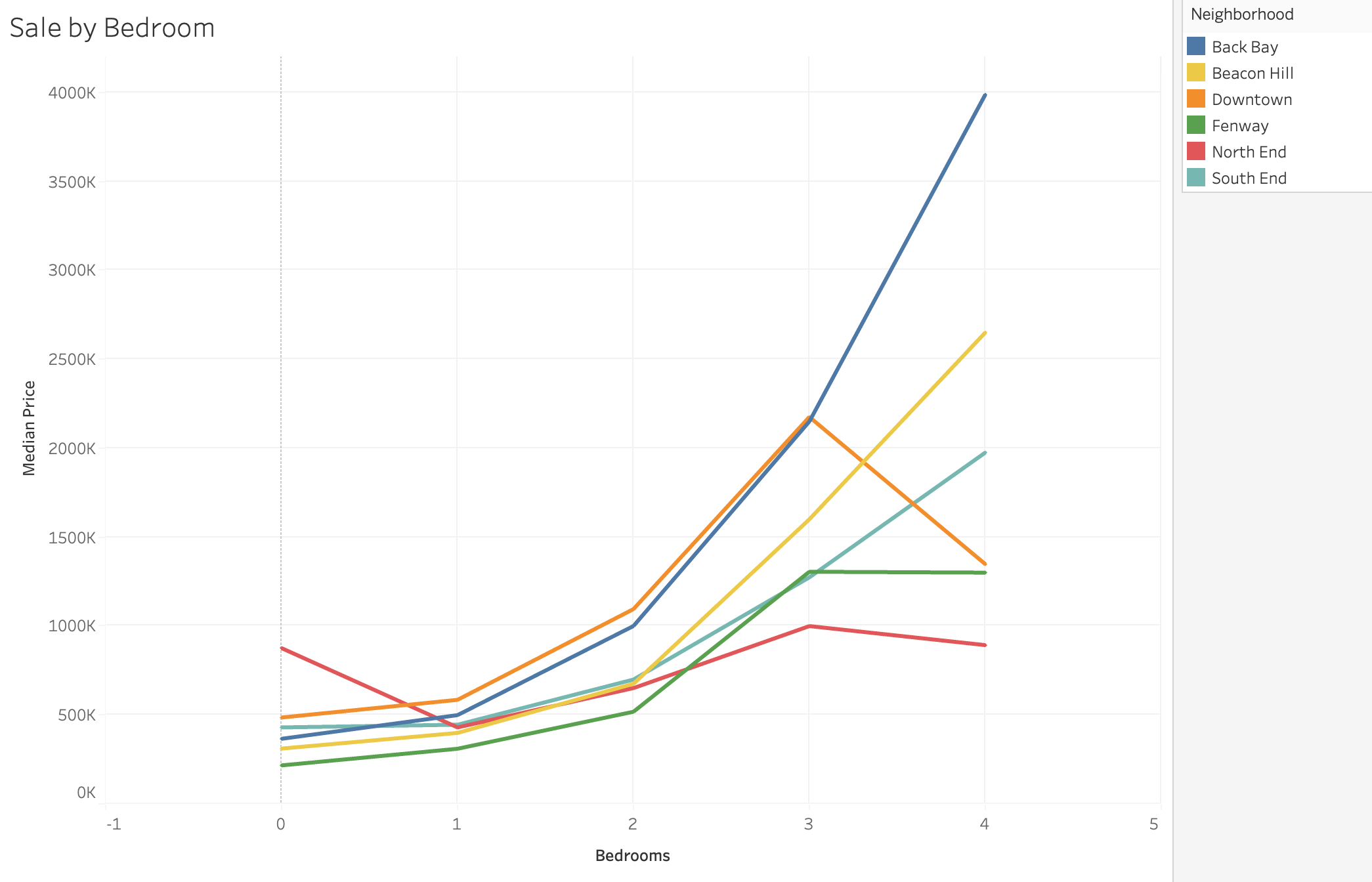

- What factors drive residential property prices in Boston?

- Has there been an increasing investor activity?

Initial Data Overview & Filtering

Discoveries & Insights

Summary

Based on the comprehensive analysis presented in your assignment on exploratory data analysis of Boston's housing market, it is evident that the city's real estate dynamics have undergone significant changes over the analyzed period. The data reveals a notable increase in median sale prices, far outpacing inflation, with particular neighborhoods like Back Bay and Downtown commanding the highest values. This trend is coupled with a decreasing sales volume, suggesting a tightening market. Moreover, the decreasing role of non-investor activity highlights a shift towards more investment-driven market dynamics. This initial analysis provides a solid foundation for understanding Boston's housing landscape, laying the groundwork for future studies and analysis.

Sources

Ostriker, Rebecca. “Luxury Condo Building Boom: Boston’s Towers of Wealth.” BostonGlobe.Com, Boston Globe, 1 Nov. 2023, apps.bostonglobe.com/2023/10/special-projects/spotlight-boston-housing/boston-towers-of-wealth/.

“Speculation and Investment in Greater Boston.” homesforprofit.Com, Homes for Profit, 2022, https://homesforprofit.mapc.org/report.

AI was used to correct grammer, spelling, and to help write the conclusion